Colourless Diamonds

When we refer to Colourless Diamonds, we mean stones graded in the range of the GIA colour scale (D–Z). These diamonds are valued for their exceptional purity of hue, with no or very light noticeable tint.

Pricing is typically evaluated using the Rapaport Price List (the “Rapaport table”), the global industry benchmark that sets average market prices according to the 4Cs – Carat, Colour, Clarity and Cut.

RapNet Diamond Index (RAPI™)

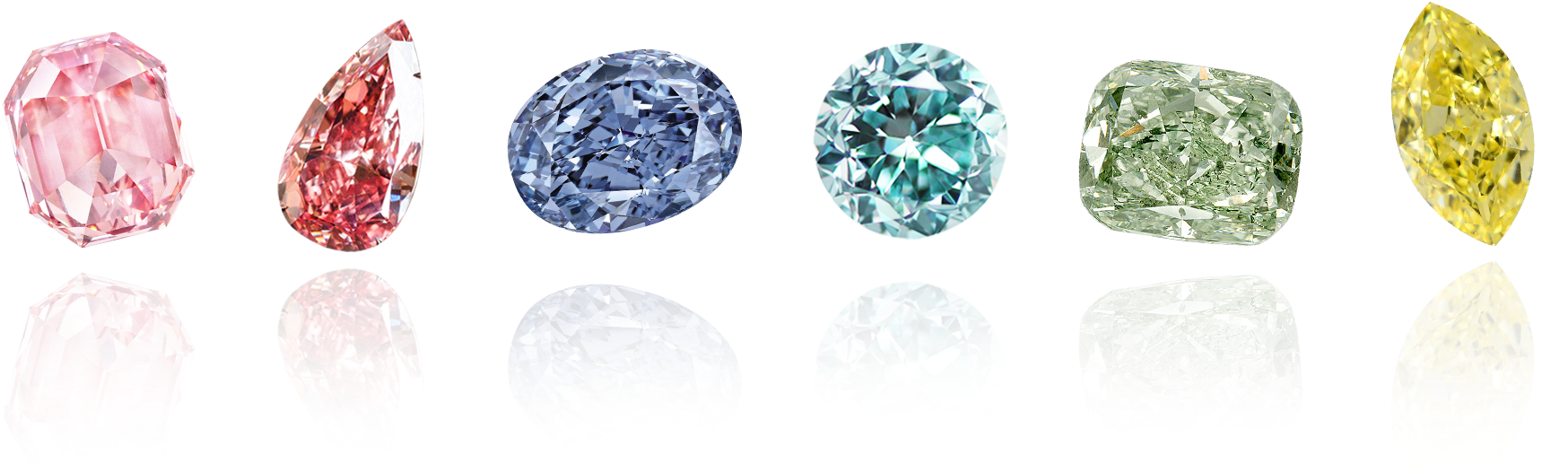

Fancy Coloured Diamonds

Diamonds with a perceptible body colour beyond the near-colourless GIA scale are considered Fancy Coloured Diamonds starting from the grade Fancy Light upwards. Unlike colourless stones, their value is not determined by the Rapaport Price List but instead depends primarily on the nature and purity of the Hue, the depth and saturation of the Colour, and the Rarity of the shade itself. Carat Weight remains a decisive factor, since larger stones with vivid colour are exponentially rarer, while Clarity and Cut play a secondary role and are often optimized to enhance the perception of colour. Fancy coloured diamonds are therefore evaluated less by standardised charts and more by the uniqueness and rarity of their chromatic qualities.

Investing in Rarity

In recent years, Fancy Coloured Diamonds have increasingly attracted attention as an alternative asset class. Their value has demonstrated remarkable resilience during periods of financial uncertainty, reinforcing their dual role as both a luxury good and a reliable store of wealth. According to the Fancy Color Research Foundation (FCRF), the asset class as a whole has appreciated by +394% since 2005.

Among the different hues, Pink diamonds have shown the strongest performance, appreciating by +242% over the past two decades, followed by Blue diamonds, which have gained +49%. Yellow diamonds, while more abundant and therefore carrying a more commercial character, have nonetheless seen a steady increase of +21% during the same period. In 2024 alone, the estimated wholesale value of Fancy Coloured Diamonds entering the market reached $4.5 billion, underlining both the scale and the growing demand for these rare gems.

As traditional markets remain volatile, Fancy Coloured Diamonds are increasingly recognised not only for their beauty and rarity but also for their ability to preserve and grow value, positioning them as a compelling investment opportunity within the broader luxury landscape.

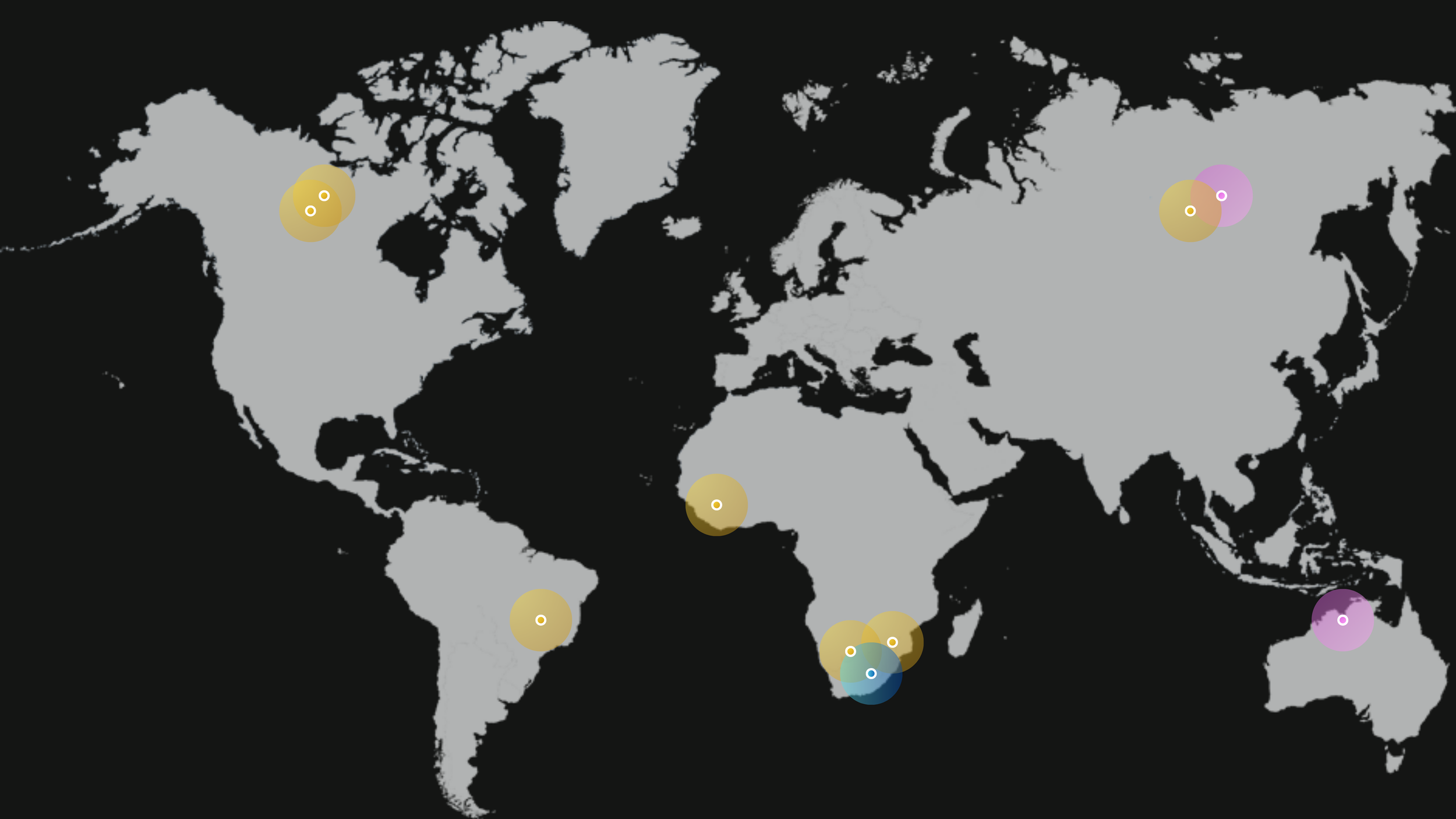

Colour Hotspots

Only a handful of diamond mines around the world yield fancy colour diamonds, making their provenance almost as important as their beauty.

Yellow diamonds are among the most abundant of the fancy varieties and provide jewellery houses with a vibrant palette of tones. Notable discoveries include a spectacular 158.20-carat Rough Diamond from Rio Tinto’s Diavik mine in Canada, one of the largest yellows ever found there. Other significant sources are De Beers’ Venetia mine in South Africa, Debswana’s Orapa and Jwaneng mines in Botswana, as well as deposits in Brazil and Russia. The Zimmi region in Sierra Leone is particularly renowned for its exceptionally vivid yellow gems.

Blue diamonds are far rarer, with Botswana and South Africa producing some of the most important stones. The Okavango Blue, discovered as a 41.11-carat rough at Orapa in 2018 and polished into a 20.46-carat Fancy Deep Blue oval of VVS2 clarity, has become a symbol of Botswana’s diamond industry. South Africa’s Cullinan Mine has also produced a legacy of exceptional blues, including the famous Blue Moon Diamond. Found in 2014, the 29.62-carat rough was transformed into a 12.03-carat Fancy Vivid blue, internally flawless cushion brilliant, which set a record at Sotheby’s with a price of $48.5 million.

Pink Diamonds reached iconic status through Rio Tinto’s Argyle mine in Western Australia. Before its closure in 2020, Argyle was the world’s only consistent source of rare pink, red and violet diamonds, contributing around 90% of global supply. Its closure has made Argyle Pinks even more prized, cementing their position as some of the most collectible and valuable gems in the world.

Brazil: Minas Gerais, Trombetas

Sierra Leone: Zimmi

Botswana: Orapa, Jwaneng

South Africa: Cullinan, Venetia

Russia: Udachnaya, Mir, Aikhal

Canada: Diavik

Australia: Argyle